tax saving strategies for high income earners canada

This bracket applies to single filers with taxable income in excess of 539900 and married couples filing jointly with taxable income in excess of 647850. Here are two additional ways to split income with your family.

2022 Federal Budget Details Continued Spending With Limited Tax Measures Video Tax Authorities Canada

Here are some money-saving tips for a busy summer full of events.

:format(webp)/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/BDQULCTIWBAOPMRGJCPFUV4UTI.jpg)

. The more money you make the more taxes you pay. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. Advanced tax strategies for.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Tax minimization strategies for. With your qualified tax advisor.

For high income earners and high-net-worth families taxes can pose a significant impediment to preserving and growing wealth particularly in cases where income or wealth is. Be diligent about your record-keeping to avoid lost receipts that can mean missing out on tax deductions. Contact a Fidelity Advisor.

Canadian tax law allows for several ways to reduce your taxes owed if you know. Tax-free savings accounts TFSAs are another option. Splitting income within a family unit is an effective way for high income earners in Canada to reduce their tax burden.

Tax Planning Strategies for High-income Earners. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. 1441 Broadway 3rd Floor New York NY 10018.

If you are an employee. There may be another option for high-net-worth individuals who may want to consider giving more to their favourite charity and earning greater benefits. So here are some tax tips to help you do just that.

Having the higher income earner pay family expenses. Like most other places if you live or earn income in Canada you will have to pay income tax. Overview of Tax Rules for High-Income Earners.

You will be saving your hard earned cash from going to the. 50 Best Ways to Reduce Taxes for High Income Earners. Contact a Fidelity Advisor.

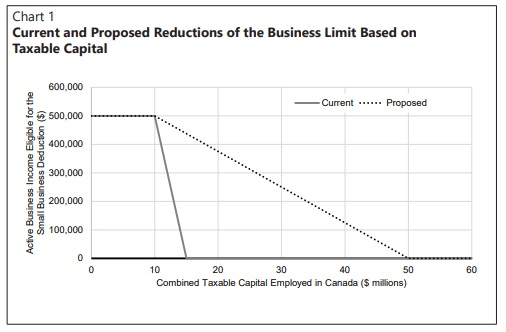

One a family trust which enables you to provide funds for your children or grandchildrens needs while reducing taxes. For the nations highest-income earners those making more than 220000 annually the amount. However prior to the 2018 federal budget high earning individuals enjoyed two.

Mon - Fri. Registered Retirement Savings Plans RRSPs Registered Education Savings Plans. More living alone but roommates multi-generational homes rising.

Here are some of our favorite income tax reduction strategies for high earners. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts. The RRSP can be a great way for higher-income earners to get a hefty tax return but can also be a way for Canadians in any tax bracket to pay less money to the government.

You can get up to 10500year of Guaranteed Income Supplement GIS tax-free 12700 for a couple from age. Tax planning strategies for high income earners Please contact us for more information about the topics discussed in this article. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started.

The math is simple. Loaning funds at the prescribed rate of interest to a spouse 1. While the money you contribute to your TFSA will be post-tax income any interest dividends or capital gains earned.

Lets start with an overview of tax rules for. Formerly known as the Working Income Tax Benefit WITB the Canada Workers Benefit CWB is a refundable tax credit for Canadians with a low income. Defer converting your RRSP to do the 8-year GIS strategy.

Making a gift to an adult family member. Canadians who earn more than 200000 per year face personal income tax rates upwards of 50 percent. Build Your Future With a Firm that has 85 Years of Investment Experience.

Through a donor advised fund a.

Thomas Sharr Income Tax Savings For The Middle Class

What Is The Standard Deduction Tax Policy Center

How To File Income Tax Return To Get Refund In Canada 2022

How To Become A Millionaire In Canada 5 Simple Steps

Courage We Have Been Here Before

Wendy Chung Rami Aziz Wealth Management Tfsa Vs Rrsp Or Both

What Is The Maximum Tax Refund You Can Get In Canada Loans Canada

How To File Income Tax Return To Get Refund In Canada 2022

What Are The Best Way To Save Tax Of Your Income Of A Company Quora

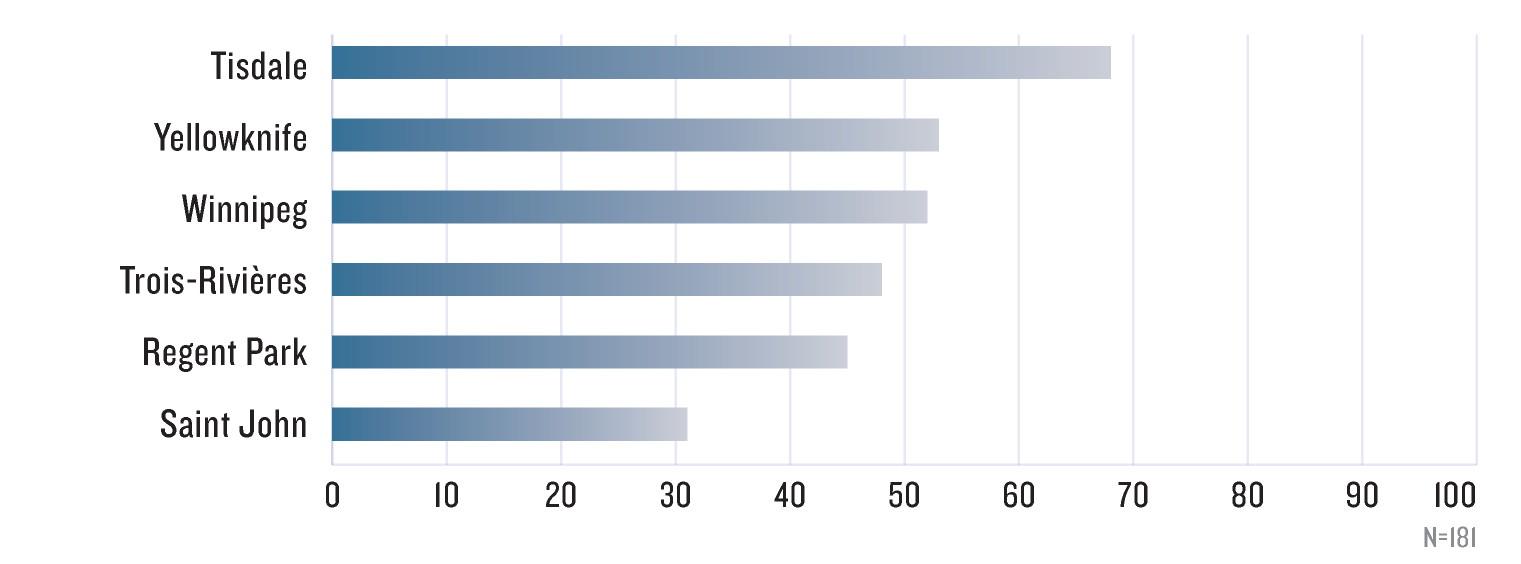

Tackling Poverty Together Canada Ca

:format(webp)/arc-anglerfish-tgam-prod-tgam.s3.amazonaws.com/public/BDQULCTIWBAOPMRGJCPFUV4UTI.jpg)

When Even The Pros Don T Understand Canada S Income Tax System You Know There S A Problem The Globe And Mail

Kitces The Right Way To Prioritize Tax Preferenced Savings Strategies

What Is The Standard Deduction Tax Policy Center

Tfsa Vs Rrsp How To Choose Between The Two Canadian Money Retirement Advice Crypto Money

2022 Federal Budget Details Continued Spending With Limited Tax Measures Video Tax Authorities Canada